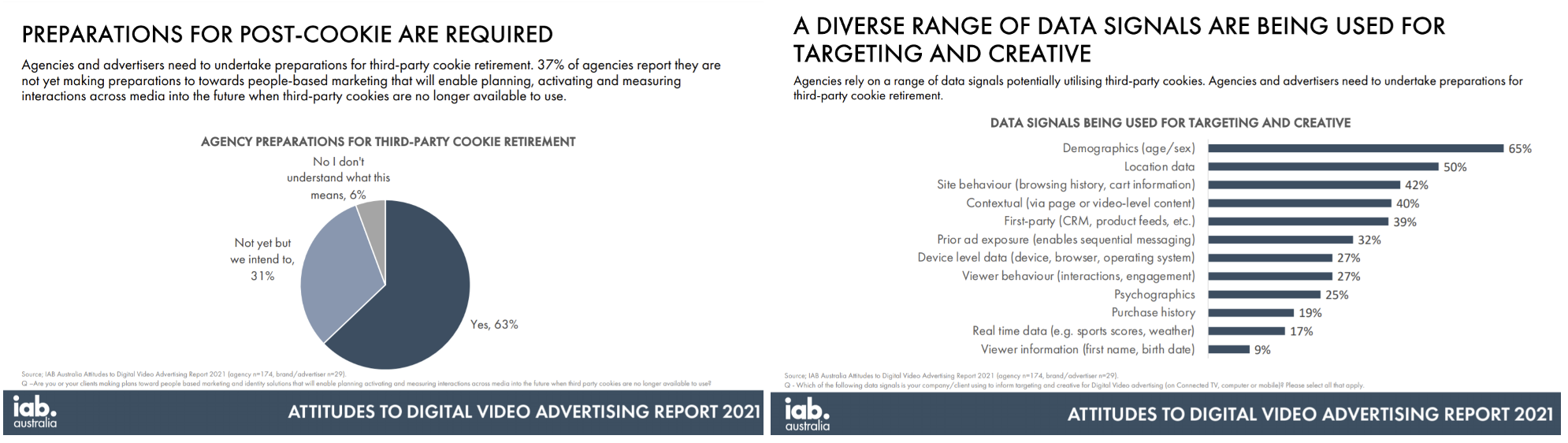

IAB Australia and the Video Council recently released a report on the 'Attitudes to Digital Video Advertising’ showcasing that investment in Video will continue to rise with over two thirds of buyers looking to increase their spend. With this increase comes a need for further education on the upcoming changes to data and privacy in video and assurance that the environments being invested in can continue to deliver for brands and advertisers. From the report we know that Media Agencies are using a diverse range of data signals for video advertising targeting and creative but preparedness for tech & regulatory changes is varied. Understanding what opportunities are available and will be available is critical. This Q&A aims to dive deeper into what the future holds for Video and how brands and advertisers can understand the opportunities available and prepare for the future.

Thankyou to those who contributed from Finecast, Verizon Media, Samba TV and Google.

____

Dylan Dharmadasa, Head of Product, Finecast

How do you see the changes to data impacting attribution and measurement of the effectiveness of video campaigns? What new ways of measuring can you suggest?

As privacy takes an increasing focus from regulators, we’re likely to see attribution and measurement solutions derived from cookies, device IDs and device graphing methodologies come under varying degrees of stress on capabilities. This will be especially true for measurement providers without direct relationships with consumers and clear consent frameworks. Identifiers used for attribution and measurement today will likely not be as readily available in the future, so it’s important agencies and clients look at diversifying their approach. It’s not so much ‘new’ as it’s ‘tried and tested’, but we would expect to see an increase in the importance of panel based measurement and attribution. Representative panels work well in an identity or privacy challenged environment as they typically won’t require one to one matching with consumers and they can bypass the closed nature of walled gardens. Therefore I’d predict a bit of a resurgence in panel based solutions. Panel solutions can open up opportunities for reach based video planning, sales uplift analysis, brand uplift metrics, footfall and more. Coupled with attribution modelling using techniques like Marketing Mix Modelling will also provide better visibility into digital video’s contribution to sales. It’s likely that the halcyon days of one to one, census level attribution will be a thing of the past and panels and modelling will be its likely successor.

As we lose old data signals, what data is coming in to replace this and how does it enhance the video offering?

Should a regulation event drive further fragmentation of identity in video, agencies and marketers will have to get comfortable with the new norm of working in a handful of vetted silos, similar to working with a handful of walled gardens. This means the holy grails like perfect universal frequency and scalable third party data will likely be replaced with first party relationships that operate within these silos. However, for much of the digital video ecosystem, attaining first party data relationships and the scale of these will have some challenges. Where we are seeing significant growth is for identity free signals in video. There are two major methodologies, in the form of cohorts and panels. Location based, contextual and audience based cohorts are rapidly growing in capabilities and will outperform first party data in scale. Cohorts have a promising future as they don’t require buyers to identify any one individual consumer, device or household and in return, publishers don’t have to pass user level signals for this to work. In many ways it’s not dissimilar to how agencies and publishers are adapting to the recent iOS privacy changes across mobile. Data in video clearly has a bright and exciting future, but we just might need to look at video through a different lens.

____

Alba Marco, Exchange Platforms Lead, Verizon Media

Do you see contextual targeting as the key solution for brands in the video space? If so, why and what tips can you provide to help them navigate this space?

I see contextual targeting as an inspiration more than the key for the new emerging identity solutions. We know contextual targeting works and it provides great reach and effective results. But we also know it's not as accurate as advertising has become in the last 10 years. Advertiser expectations in terms of targeting are changing as leading technology can offer more sophisticated first-party based audience, household addressable and viewership targeting.

Contextual targeting was born in an era when machine learning was barely a thing yet. Today we are surrounded by algorithms and automation so the key solution for today’s problem can’t be addressed by only adopting a solution from the past. We need to adapt that 'contextual' concept to this new era of algorithms and privacy. By using contextual as a core strategy combined with machine learning - which is powered by 1st party data and leverages all the information available on the page such as subdomain, keywords and media channels - we will create a more accurate context and provide a more engaging experience without the use of cookies.

We’ve already seen publishers stepping forward using cohort-based solutions such as Google's FLoC or Verizon’s Next Gen Audiences. Cohort-based solutions rely on having a standardized taxonomy that publishers would be able to adopt and apply to their data which will naturally lead the supply side to a more standardized tech approach driving even more transparency and brand safety for advertisers. I can only see positive outcomes coming out of the new cookieless world!

My tips would be:

- Firstly, prioritise full stack solutions. Connected TV viewership increased 22% YoY and only platforms with 1st party data will be able to leverage household graphs which clearly benefits Connected TV’s audience based targeting

- Secondly, start testing identity solutions ASAP. Cookieless browsers such Firefox or Mozilla represent 30% of the Australian market share - that’s ⅓ of the cake! Now is the perfect time to start testing. And by testing I mean starting to increase yield and performance across that 30% and feel confident moving onto a 100% cookieless world when Chrome sunsets cookies.

____

Yasmin Sanders, Managing Director AU, Samba TV

How do you see the changes to data impacting attribution and measurement of the effectiveness of video campaigns? What new ways of measuring can you suggest?

Samba TV’s research reflects the methodology and capability for measuring advertising effectiveness and attribution across TV and digital channels. As the media landscape becomes more fragmented across multiple platforms and screens, marketers are more challenged than ever to assess their holistic campaign performance to ensure the strongest ROI.

This is important because for the first-time advertisers can measure attribution of cross-screen strategies against real-world business outcomes such as website visits / purchases, location visits, and brand awareness. Leveraging these valuable insights allows advertisers to make crucial in-flight optimisations and more effective strategic decisions for future campaigns. They can also apply the learnings to media mix decision-making to ensure each advertising dollar is being allocated correctly.

Three important ways of measurement and attribution in this new landscape include:

- Multi-touch attribution - is crucial for understanding the value of each ad exposure throughout the consumer journey. The complexity of modern marketing strategies requires a deep understanding of effectiveness and efficiency across all tactics and screens.

- Causal attribution (TV + Digital) – The importance of measuring incrementality cannot be overstated. While digital media has long used control groups to understand the causality of advertising effectiveness, Samba TV has also developed a patent-pending methodology for creating synthetic control groups. This ground-breaking concept allows marketers to measure the incremental lift of TV commercial attribution.

- Conversion measurement – the ability to measure attribution of cross-screen media campaigns is integral for advertisers seeking actionable insights on ROI drivers. Attribution measurement across all screens also allows advertisers to optimise their overall media mix. Once there is a clear understanding of which TV partners and digital tactics are driving the highest conversion rate, advertisers can adjust their media mix accordingly and, as a result, ensure they’re getting the most efficient return on ad spend.

When it comes to your own video product and privacy compliance, do you think it fits into the future world? How do we ensure consumers feel more comfortable trying new things?

Since its inception, Samba TV has been a proponent of the right to privacy and pioneered Smart TV opt-in and data protection policies in advance of General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and the similarly stringent California Privacy Rights Act (CPRA) Specifically for the Australian market, Samba TV has aligned its practices with Australia’s Privacy Act 1988 and the Australian Privacy Principles. The company has extended its workflows and user-interface to provide a full-featured consent management platform (CMP) for Smart TVs, Samba TV’s Privacy Manager, and has deployed it as an open standard that other players in the ecosystem can adopt at no cost.

The Smart TV Privacy Manager provides progressive consumer protections within Smart TVs, giving them the power over what data is shared and to whom. The integration of the Privacy Manager, featuring the globally accepted IAB Transparency and Consent Framework (TCF), is being rolled out in partnership with major global brands, publishers, and platforms to offer consumers industry-first privacy controls on Smart TVs.

Additionally, as consumers shift fluidly between connected devices throughout their daily lives, marketers are challenged to map out the consumer journey while trying to understand the cumulative impact of their advertising in order to make optimisations and improve performance. That process is complicated by the fact that each consumer uses multiple devices, and each device can have multiple unique identifiers. In this scenario, Samba TV’s proprietary identifier, SambaID (part of its Samba TV Identity solution), gives marketers, publishers, and platforms the ability to transact with each other using a variety of different currencies to optimise against, even in the post-cookie future.

Samba TV’s proprietary identity resolution tools process and deduplicate customer data to identify which phones, tablets, PCs, TVs, and other digital devices belong to specific households with greater than 90 percent accuracy. This process begins with 100 percent opt-in, privacy-sensitive deterministic data pulled from Samba-enabled Smart TVs.

____

Erin Tavallai, AuNZ Ads Privacy Lead, Google

Do you see contextual targeting as the key solution for brands in the video space? If so, why and what tips can you provide to help them navigate this space?

The task at hand for marketers facing the deprecation of third-party cookies is to ensure that their marketing strategies are equipped to deal with less data, from more complex and varied sources. This means that contextual targeting will have to be used alongside other durable tactics such as maximising first-party data, adoption of machine learning, and cohort-based targeting. With video ads specifically, it’s important to remember that the impact to targeting and measurement by third party cookie deprecation is heavily dependent on the media environment . CTV identifiers are not expected to change at this time and therefore there will be very little impact in situations where buying takes place in an owned and operated environment, such as Google's YouTube.

That said, depending on a marketer's KPIs, the solutions that they use may employ a combination of tactics that will deliver results. There are a few different privacy-first signals and techniques that should be in every marketer’s “toolbox”:

- Contextual signals: Can be used to enable contextual targeting, serving relevant ads based on content-based and environmental signals

- First-party data: these direct-consent relationships will be the starting point for every privacy-first audience strategy - developing valuable insights, re-engagement with a clear value exchange, and extending to find similar users are all tactics that marketers will continue to adopt.

- Machine learning and automation: these make forward looking predictive marketing possible, helping to identify key trends and patterns

- New privacy-first technologies, such as cohort based audiences: these new signals will allow marketers to show ads to groups of users based on their interest - expanding reach beyond first-party data in an efficient way

Contextual targeting can be a formidable tactic in its own right, because of the power of reaching people with a message that relates directly to their current environment - but perhaps even more so when used in combination with the other tactics above. In the case of first-party data, you can enhance and expand your targeting with contextual signals. Furthermore, it’s possible to leverage machine learning to find similar audiences at the intersection of first party data, contextual signals, and cohort targeting, who might be interested in your product or service. Enabling targeting expansion helps advertisers to prepare for a future with limited third-party cookies and identifiers as it helps find high-performing audiences based on the campaigns existing core targeting or by expanding your own core first-party targeting on Google properties.

Are there any brands pivoting to the future already when it comes to data? Can you give an example?

A great example of a brand who has had to adapt to set themselves up for success in the privacy first future is Mondelēz. They were early to recognise the growing importance of direct customer relationships as the marketing landscape has shifted. But like many other consumer packaged goods companies, Mondelēz sells their products to consumers through retailers.

That’s when the company decided to work with Google Marketing Platform Partner MightyHive to develop a first-party data strategy that carefully considers the “value” that’s being offered to consumers in exchange for their data. They took one of their candy brands, Sour Patch Kids and encouraged fans of the candy to go to a website where they could customize their own box of the multi-colored, sugar-coated candies. They can hand-pick the flavors, and put their name on the packaging.

“When people choose to connect with us directly and share information, we ensure that a high bar is met in terms of the value they get in return,” explained Jonathan Halvorson, Global VP of Agencies, Digital, Media & Data.

Once you’ve determined how to use customer information to deliver better experiences, it's important to communicate to people clearly so they know what they’re agreeing to. Make sure your privacy policy is easily accessible and up-to-date with your latest practices, and consider explaining the contents of your policy in clear language. Tell your customers how they can collect, including how they can opt out of tracking.

For more examples of brands leaning into leveraging their first-party data review First-party data playbook for marketing: A guide to inspire APAC brands and to help guide you through today’s privacy landscape, we put together a Marketers Privacy playbook.