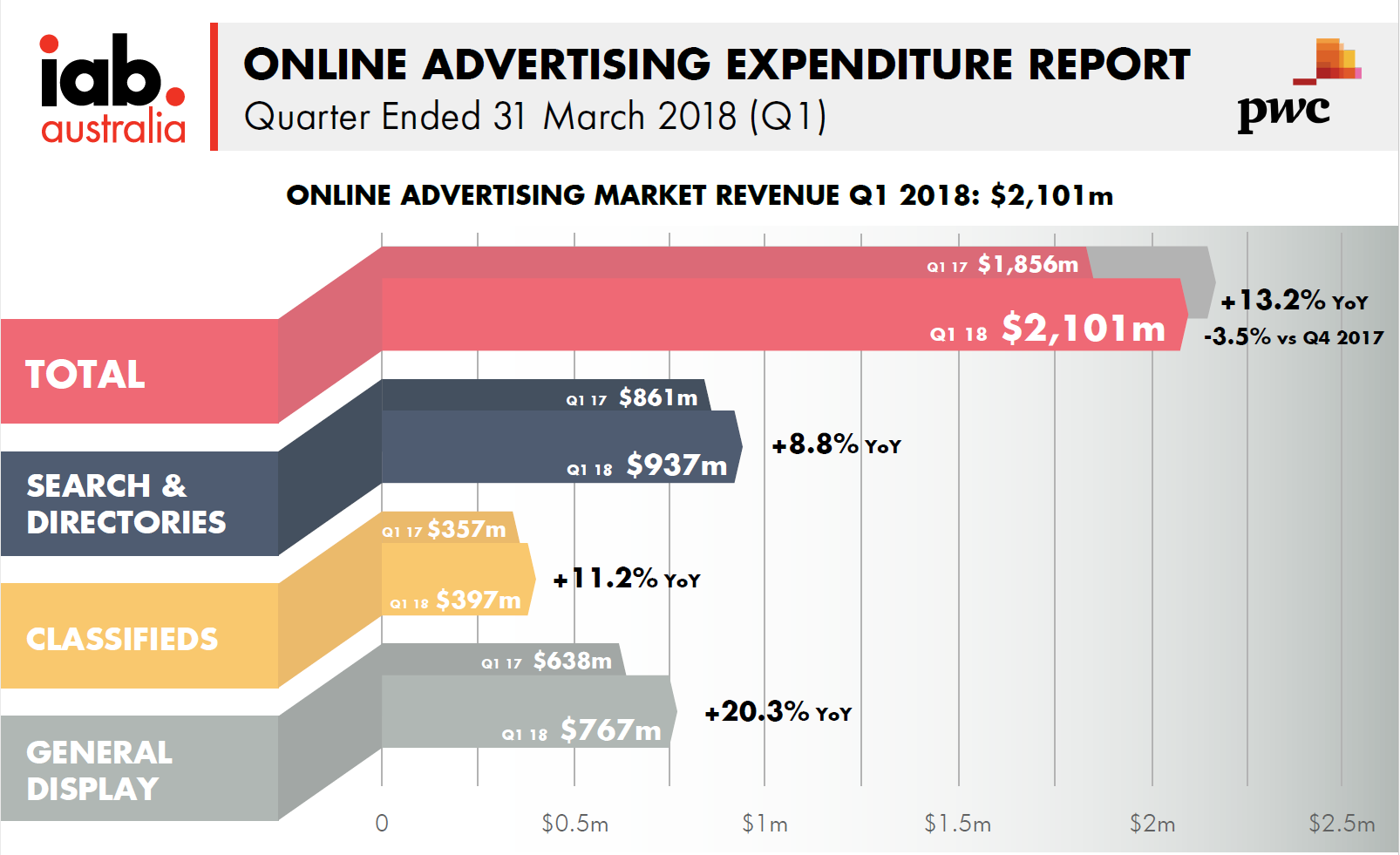

Sydney – 31 May, 2018: Digital advertising revenue reached $2.1 billion for the first quarter of 2018, driven by significant growth in both video and mobile advertising according to the Online Advertising Expenditure Report released today by IAB/PwC. The report also highlights a shift in advertising spend with marketers favouring General Display advertising over both Classifieds and Search and Directories.

View the full report and infographic here.

While the overall digital advertising revenue increased 13 percent year on year, General Display advertising recorded 20.3 percent growth in the same period. Classifieds increased 11.2 percent year on year and Search recorded 8.8 percent year on year growth. Both video and mobile advertising were up (38 percent and 39 percent respectively) each in Q1 2018 versus Q1 2017, with video reaching $320 million for the quarter, representing 42 percent of the total General Display advertising category.

Total revenues for Q1 were down 3.5 percent versus the December 2017 reflecting a standard seasonal trend where the March quarter tends to be softer following the Christmas period.

“Our market is chameleon-like, mirroring the significant shifts in consumer behavior towards mobile and video, so it’s little surprise to see an increased investment in these formats ,” said Gai Le Roy, IAB Director of Research. “While it’s likely we will see a continued softening in some of the more established digital ad revenue streams, we fully expect mobile and video advertising continue to surge as marketers explore and challenge the possibilities of digital to build trust and reputation for their brands.”

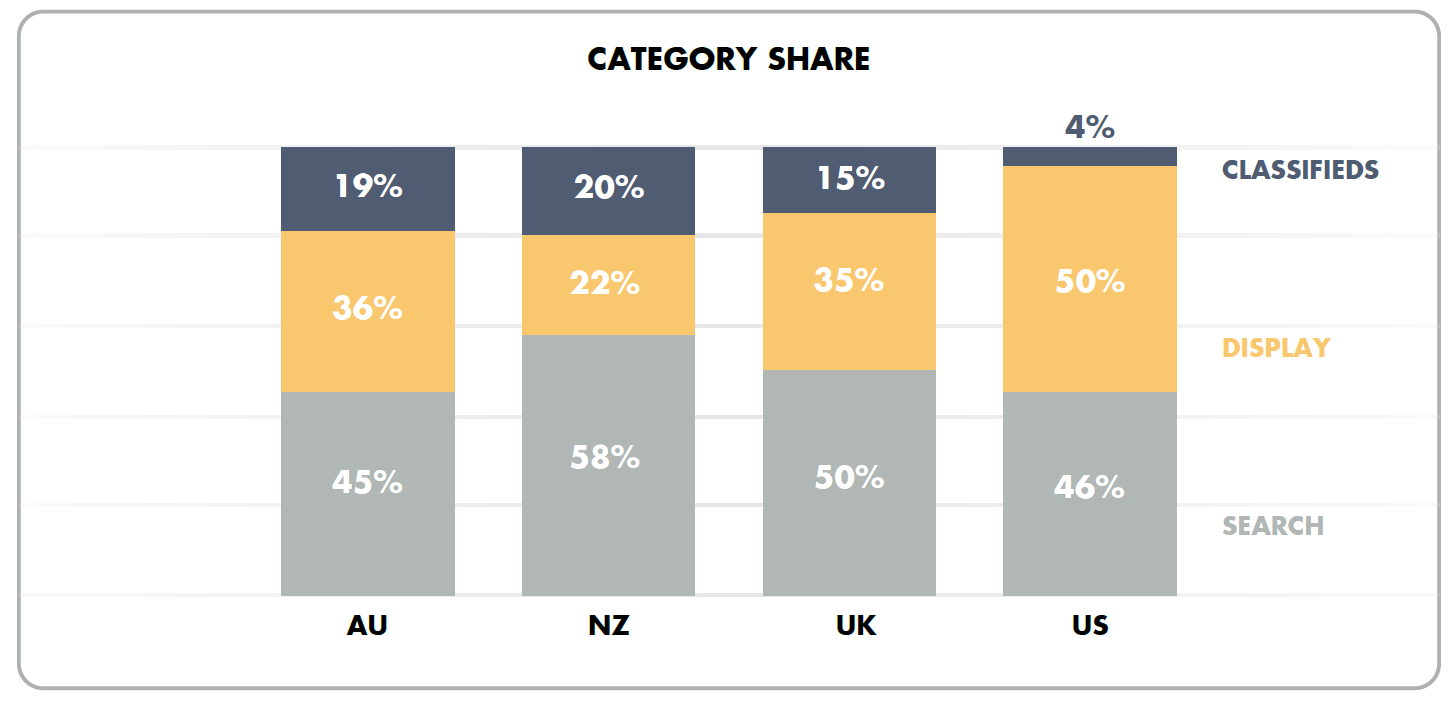

Now in its 11th year of revenue reporting for the digital industry, the IAB / PwC Online Advertising Expenditure Report is recognized as the industry standard for independent market level industry intelligence in Australia. The latest IAB / PwC OAER also provides data comparing international markets from a variety of IAB global reports on the distribution of dollars across digital revenue streams. The data shows that the Australian market more closely resembles the UK than either the US or NZ markets, with Display advertising representing 36 percent and 35 percent of ad expenditure in Australia and the UK (respectively) compared to 50 percent of ad spend in the US. Similarly Australia’s share of video advertising as a proportion of total online advertising is 38 percent, in line with the UK’s 39 percent and significantly higher than both the US (29 percent) and NZ (23%).

According to the Q1 report, auto advertisers continue to be the largest investors in digital display advertising at 18.3 percent share of spend, however the FMCG industry is increasing its spend and is now the largest advertiser category for Video advertising at 12.2 percent. Overall the range of industries investing in video has diversified over the last 12 months, with industries including Finance (10.8 percent) and Telecommunications (8.7 percent) increasing their Video spends. The top five spenders in video who make up a combined 47.4 percent of the total market include FMCG, Finance, Telecommunications, Retail and Automotive.

The latest report shows Search and Directories continues to represent the largest proportion of the online advertising market in Australia at 45 percent ($937m) for the March quarter, with General Display at 36 percent ($767m) and Classifieds at 19 percent ($397m).

Mobile advertising expenditure decreased in the March quarter to $909.1 million after record growth in the December 2017 quarter during the Christmas retail period. 56 percent of mobile advertising expenditure is attributed to Mobile Search and 44 percent to Mobile Display. Smartphones continue to attract a greater share of advertising expenditure at 90 percent compared to tablets’ 10 percent share, increasing its share from the prior December quarter (80 percent and 20 percent respectively).

Independent research company, CEASA confirmed in March 2018 that digital represented 50.7% share of the total advertising market expenditure of $15.6B for calendar year 2017.

The full report is available for IAB Australia members.

/Ends

About the Interactive Advertising Bureau

The Interactive Advertising Bureau (IAB) Limited www.iabaustralia.com.au is the peak trade association for online advertising in Australia and was incorporated in July 2010. As one of over 43 IAB offices globally, and with a rapidly growing membership, IAB Australia’s principal objective is to support and enable the media and marketing industry to ensure that they thrive in the digital economy.

The role of the IAB is to work with its members and the broader advertising and marketing industry to assist marketers to identify how best to employ online as part of their marketing strategy, to better target and engage their customers and build their brands.

By addressing the core pillars of growth of the online advertising industry – simplified and standard online audience measurement, research, and online operational standards and guidelines, and regulatory affairs, IAB Australia leverages the skills, experience and commitment of its members to advocate the benefits of online advertising by acting as an authoritative and objective source for all online advertising issues whilst promoting industry-wide best practice.

IAB Australia is a registered not-for-profit organisation; membership fees and revenue generated is invested back into the IAB’s membership benefits such as resources, events, reporting, and industry representation.

For further information about IAB Australia please contact:

Vijay Solanki

CEO – IAB Australia

T: 0409 089 620

E: Vijay.Solanki@iabaustralia.com.au

Pru Quinlan/Sue Ralston

Einsteinz Communications

T: (02) 8905 0995