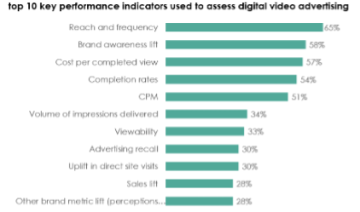

Tuesday 6th June 2023: Economic conditions and the impending retirement of third-party cookies have influenced how agencies are assessing digital video campaigns this year with an increased focus on measurement tools providing campaign delivery and sales performance results according to IAB Australia’s Video Advertising State of the Nation Report. The report, which was released today also found marketers are placing a greater focus on assessing brand impact across screens this year, rather than digital only brand lift.

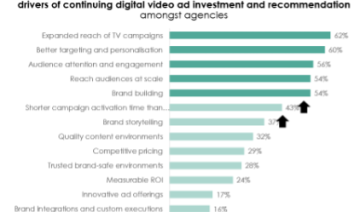

Brand building was identified in the Report as the dominant objective for digital video advertising campaigns with agencies reporting high satisfaction with digital video’s ability to deliver on brand objectives. However, budget scrutiny has resulted in a significant increase in the use of performance objectives and measurement to increase purchase intent and sales.

Reach, targeting, attention and brand building continue to drive usage and recommendation of digital video advertising overall. The ability to reach audiences no longer on linear TV was identified as the main reason why advertisers and agencies use digital video on CTV as a significant or regular part of their activity. However, budget, cost, and challenges in proving return on investment were cited as key reasons CTV is not a more regular part of digital video activity amongst less frequent users.

Gai Le Roy, CEO of IAB Australia said, “With budgets all under close scrutiny marketers are having to work harder and smarter to ensure their investment in the $3.3 billion video ad market delivers ROI. Top of mind for most is how to balance activity to meet both upper and lower funnel objectives.

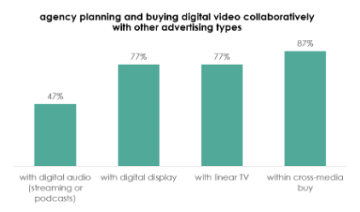

“As linear consumption continues to shift to digital, we’ve also seen a doubling of the number of agencies moving to a centralized and consolidated screens and format approach for both planning to and buying to help understand reach and cross screen campaign impact,” said Le Roy.

Additional findings from the IAB Australia Video Advertising State of the Nation Report include:

- Short-form video remains the most often used format. There has been an increase in the frequency of using shoppable ads and rewarded video.

- Integration of digital video planning and buying with TV and other media activity is increasing, with linear TV and digital advertising increasingly being planned and bought by the same agency teams. Agencies are also understanding the nuances of each environment by increasingly adjusting creative to suit the different media environments.

- Agencies rely on a diverse range of data signals. Some of these targeting options potentially utilise third-party cookies and there is a significant proportion of agencies and marketers not yet making steps to people-based marketing, however the usage of first-party data signals has significantly increased since last survey.

- Measurement complexities are challenging the advertising industry. Cross-screen measurement for both media planning and campaign delivery reporting are cited as key challenges that industry is looking to solve for the future.

- Currently there is minimal measurement and usage of carbon emissions data being used to inform advertising decisions. Many agency respondents have the view that carbon emissions will become a more prominent metric but currently there is little clarity on how it works.

Australian advertisers spent nearly $3.3 billion on digital video advertising in 2022. Video ad expenditure increased 12% on year prior, representing 60% of general display advertising. Connected TV yields the greatest share of content publishers’ video inventory expenditure, taking share from both mobile and desktop in 2022.

The IAB Australia Video Advertising State of the Nation Report was conducted by independent research company, Hoop Research Group with fieldwork conducted in May 2023 with 133 advertising and agency decision makers completing the survey. The survey gathered industry information on video advertising that appears on connected devices such as connected TV, computers (desktop/laptop), smartphone or tablets, and included video advertising in all varieties of long-form and short-form digital content and social platforms.

The 2023 results in this report were compared to results from the first wave of the IAB Australia Video State of The Nation Video survey conducted in 2021 and the second wave conducted in 2022.

/Ends