It seems the next media frontier is close at hand, and the technology could literally leave consumers even more immersed—and invested—in the content that surrounds them.

Virtual reality (VR)—a concept that has been talked about for decades but out of reach for most consumers—is fast becoming a reality itself. In fact, at this year’s NewFronts, 17 different presentations highlighted current or upcoming content available in VR or 360-degree video formats.

Yet despite the excitement around this innovative platform, many VR devices aren’t widely owned, and little is known about the audience that will grow into the first wave of VR content consumers.

It’s important for brands to understand how consumers plan to engage with this advancing realm, so Nielsen recently conducted an online study of more than 8,000 consumers to understand how technology affects perceptions and intended behaviors relating to these emerging options. Each respondent was served one of 100 different videos, ranging from news clips to brand videos to product reviews, and attitudes toward VR were assessed after exposure.

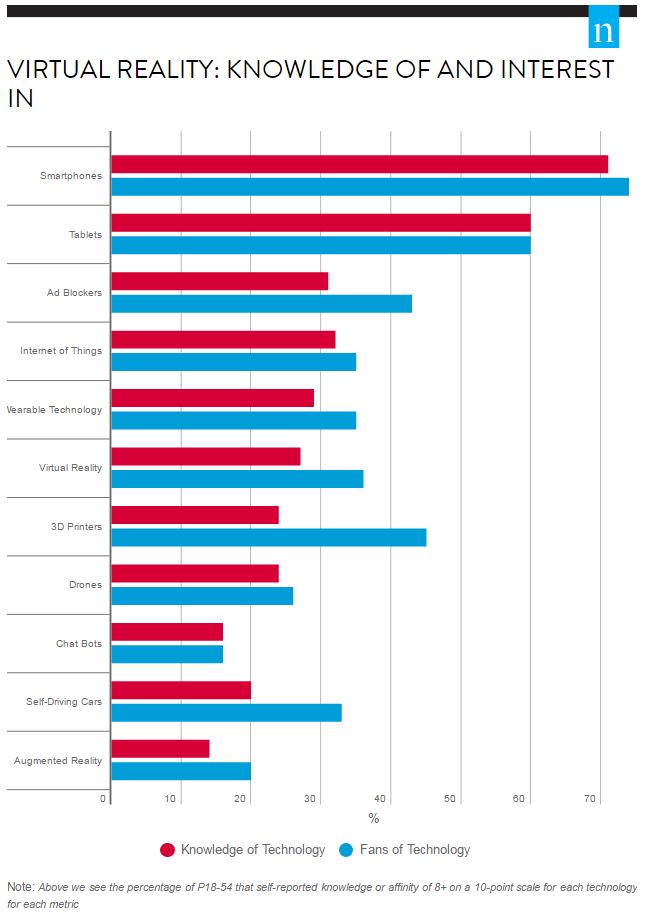

The study, conducted by Nielsen’s Media Lab team, found that adult consumers 18-54 feel about as knowledgeable about VR as they do about other popular tech trends, including wearables, 3D printing and the internet of things.

Like many new technologies, it seems that VR has more fans than experts. In fact, about one-fifth of the audience surveyed said they considered themselves knowledgeable about VR, while nearly one-quarter felt very positively about the technology.

Beyond segmenting the sample based on simple knowledge of VR, the Nielsen study also segmented the respondents into categories critical to the adoption of VR: PaVRs (Pavers), those who are more likely to purchase VR within the next year and pave the way forward, and ConVRts (Converts), whose interest in the technology increases with new information, but aren’t likely to be among early adopters.

PaVRs represent roughly 24% of the U.S. 18-54 population. These video consumers say it’s likely that they will use or even possibly purchase VR technology in the next year. These consumers tend to be younger and have higher-than-average incomes, making them a desirable audience for both publishers and advertisers.

ConVRts make up about 20% of the U.S. 18-54 population. While these video consumers aren’t the most likely to try VR on their own, exposure to even just a little information about the technology and applications boosts their interest levels.

So how important are these two segments to the future success of this futuristic technology?

For publishers, agencies and networks, the potential within the PaVR segment can’t be stressed enough. The study found that that these consumers watch a five more television networks in a given month than the average consumer, they spend 8% more time watching television and they spend 7% more time online.

The study found that this segment is also appealing because of its shopping behavior. PaVRs also outspend the average consumer in most purchase categories, including nearly twice as much on live event tickets (195%), quick-serve restaurants (179%) and alcoholic beverages (175%).

“Advertisers will be pleased to find that PaVRs are ‘triple-A’ consumers: they adopt new products and service, they advocate for the brands they love and they appreciate premium quality—and are willing to pay a premium price,” said Harry Brisson, Director of Lab Research at Nielsen.

But opportunity isn’t limited to the early adopters.

During the study, respondents were exposed to publicly available video content about the potential applications of VR, ranging across gaming to health care to art. The videos included content created by VR device manufacturers, broadcast news networks and independent YouTube creators.

The study found that many consumers increased their familiarity and interest in VR technology with as little as 2 minutes of exposure to content. In fact, just over 50% of viewers showed some increase in their likelihood of purchasing or using VR technology after their brief informational experience. If these participants were to learn even more about VR, it’s reasonable to expect that their attitudes would evolve even further. Additionally, 48% of consumers considered VR more likeable after learning more about it, as well as 48% that were more likely to look up more information afterward. A separate Nielsen Media Lab study used a similar methodology, but instead exposed over 150 respondents to content in a virtual reality headset, resulting in an even great impact: 68% identified as more likely to purchase or use virtual reality technology after the experience. These shifts in intent demonstrate how more education and exposure will continue to change consumer attitudes about virtual reality.

Not all experiences are equally impactful, though. While all informational videos tested drove positive results, the degree of impact varied considerably. The most effective video was 12.5 times as effective as the least effective video at driving improved attitudes toward virtual reality. Generally, videos that emphasized personal experience with VR and featured non-gamers were more likely to drive usage intent, whereas product reviews and informational content was more likely to drive familiarity— though the most effective videos were top performers for both measures.

Knowing how PaVRs and ConVRts adopt, react and potentially convert to a future where VR may grow in both adoption and application will be critical for all VR stakeholders looking to reach and engage their best consumers.

(This article was originally published by Nielsen Insights, Sept. 2016. Click here for more great content from Nielsen Insights.)