Our colleagues at IAB US have published their 2025 Outlook Study ahead of the Annual Leadership Meeting in late January in Palm Springs. The Study provides valuable insights into total market investment for 2024 and projections for 2025, based on input from a diverse range of senior marketers and agency leaders. Below is a summary of key findings alongside some Australian context. The full report is available for download here (please note, a free account is required).

Total Market Growth

The IAB estimates that US digital ad spend grew by 11.8% in 2024 compared to 2023, bolstered by investments related to the Olympics and the US election. While Australia’s December quarter data is not yet available, the first three quarters of 2024 showed 11.9% growth in the local digital ad market. However, growth across formats and environments varied significantly.

In contrast, Australia’s slower growth in 2023 (3.7% year-on-year compared to the US’s 7.3%) also influenced the 2024 performance. Although the Olympics contributed some upside, the Australian market was still recovering from previous slowdowns.

For 2025, the US is forecasting solid digital ad market growth of 7.3%. Notably, the US figures currently exclude retail media from the base calculation, though projections for retail media are addressed below.

Channels, Formats, and Focus Areas

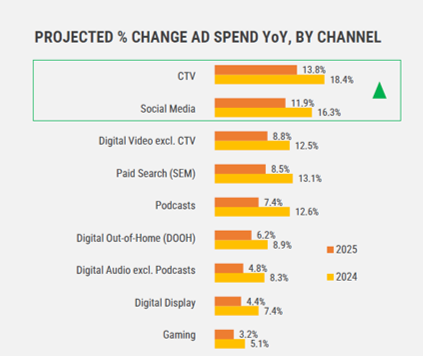

What’s driving this growth? Excluding retail media, Connected TV (CTV) led the way in 2024 with 18.4% growth, a trend expected to continue in 2025 (13.8% growth). CTV is followed by social media, video (excluding CTV), and paid search.

In Australia, these growth areas align, though podcasts and digital audio remain in a higher growth phase, albeit from a smaller market share.

Source: IAB 2025 Outlook Study

Retail media is another standout area, with marketers reporting a 25.1% increase in retail media investments in 2024 and projecting a 15.6% rise in 2025.

A growing trend is the focus on publishers with first-party data, with 55% of buyers indicating they plan to prioritise such placements. Similarly, creator partnerships continue to gain traction, with 48% of buyers intending to invest more in collaborations with creators across platforms like podcasts and social media.

Marketing Objectives, Operational Efficiency, and Measurement

As expected, customer acquisition remains the top goal for media investments. The trend toward performance-focused media continues, with 54% of buyers planning to increase the share of their media budget allocated to performance advertising, while 22% aim to boost brand advertising. Marketers cite pressure to demonstrate ROI as the key driver behind this shift.

Concerns about a slowing US economy and access to first-party data have lessened in recent years. However, cross-channel media measurement and managing reach and frequency remain top challenges. Interestingly, 35% of brands express concerns about having sufficient budget to invest in emerging channels—marking a significant increase from the previous year.

Buyers are also dedicating more time and resources to measurement initiatives. Focus areas for increased investment include:

• Cross-platform measurement (64%)

• Attribution modeling (61%)

• Marketing mix modeling (56%)

• Attention metrics (47%)

AI in Media Planning and Activation

The adoption of generative AI in media planning and activation is on the rise, with 42% of buyers actively using it and an additional 36% exploring its potential. To mitigate risks and inaccuracies, over half of those using generative AI have implemented mandatory human oversight of outputs.

The full IAB US 2025 Outlook Study can be downloaded here (note: a free account is required).

Looking ahead, the IAB Australia Internet Advertising Revenue Report for the 2024 calendar year will be released in late February and made available to member organizations. Historic reports and data can be accessed here.