7 APRIL, 2020 SYDNEY: As Australians are being asked to stay home in an effort to flatten the curve of coronavirus (COVID-19), they are spending significantly more time with online food and cooking content. And it’s younger audiences that are driving the increases in time.

- 71% increase in time spent on online food and cooking websites4

- Australians aged 13-24 increased their time spent online with food and cooking content by 144%2

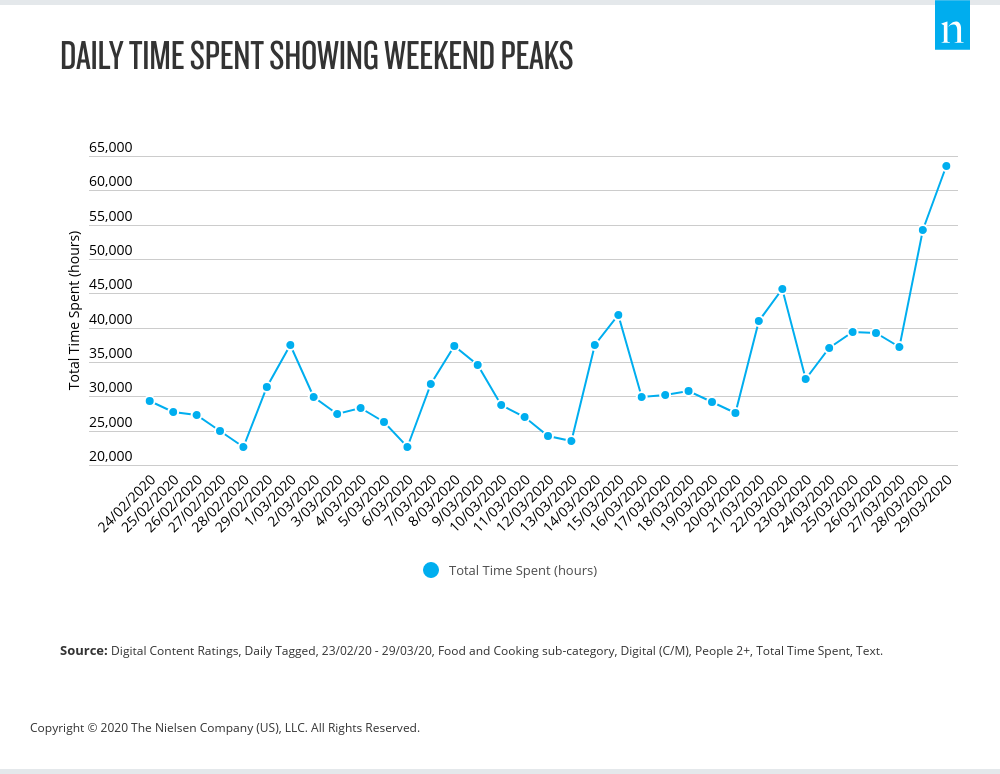

- Sunday 29 March recorded the highest daily time spent consuming food and cooking content in 2020

Nielsen’s daily Digital Content Ratings data showed a 70%1 increase in time spent on Sunday 29 March versus Sunday 1 March and Sunday 29 March recorded the highest Daily Time in 2020, with a combined total of 63,555 hours spent on food and cooking websites.

Nielsen Digital Content Ratings reported a shift in online audience behaviour at the time when the Government announced stage 1 restrictions on Sunday 22 March, announcing the closure of clubs, pubs, restaurants and cafes and recommending families to stay at home. Nielsen data also showed that on the last weekend of March, Australians spent 71% more time consuming food and cooking content online when compared to the last weekend of February 4.

Nielsen’s Managing Director of Media and Sports, Monique Perry said “We are adjusting to our new reality of more time at home cooking and have leaned more heavily than ever on Australia’s content-rich food and cooking websites. Media agencies, advertisers and brands have significantly more opportunity to engage with consumers through this category through these difficult times. It’s a real opportunity to talk to Australian’s while they are planning and preparing meals for their families and this could support both tactical and long term brand building campaigns.”

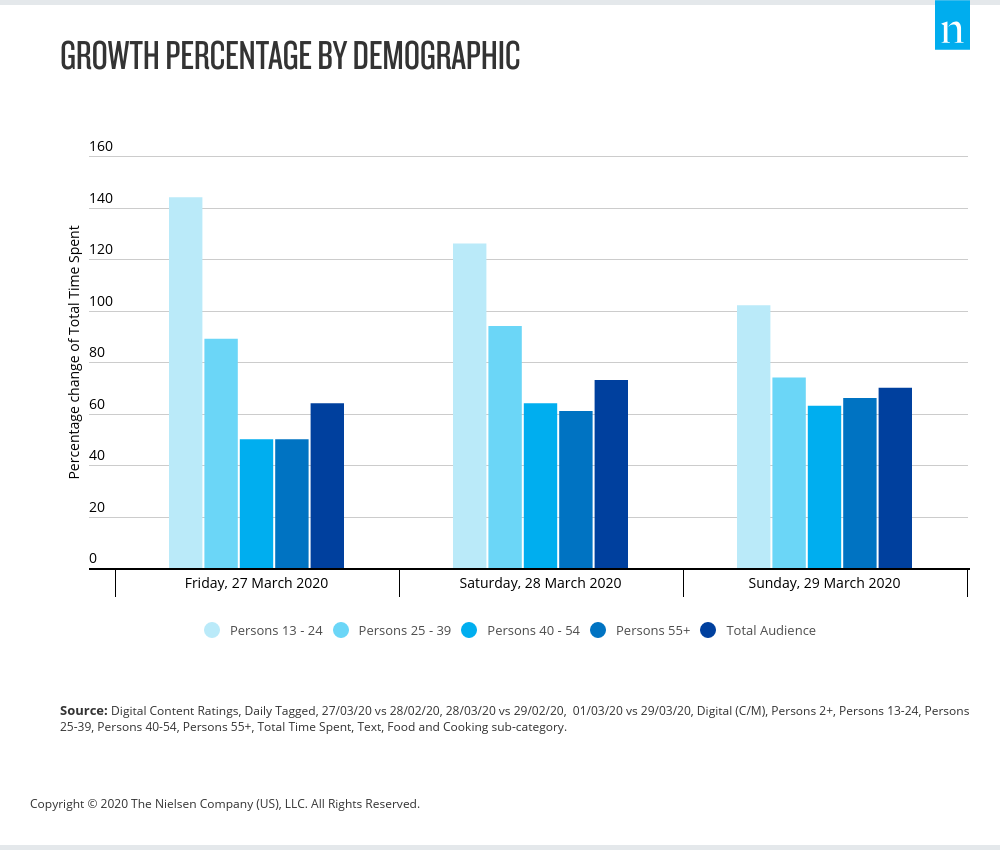

Nielsen Digital Content Ratings saw an uplift across all demographics for cooking websites. With the highest growth coming from Australians aged 13-24.

Looking at the last weekend in March, the biggest increase to time spent with online food and cooking content compared with the prior month was reported by each age bracket as per below.

- People aged 13-24 +144% on Friday 27th March

- People aged 25-39 +94% on Saturday 28th March

- People aged 40-54 +64% on Saturday 28th March

- People aged over 55 +66% on Sunday 29th March

Gai Le Roy, CEO of IAB Australia, commented: “It looks like Australians have finally admitted to themselves that they are going to be eating at home a lot in the coming weeks and have started to look for recipe inspiration to add a bit of variety to their normal repertoire of meals. When our time at home is increased and with many of us struggling to remember what day it is at times, it is interesting to see the habitual pattern of Sunday being the key meal planning and recipe hunting day being retained.”

And, to coincide with the growing interest in cooking at home, Nielsen Homescan data for the four weeks ending March 22 revealed that Australians are buying more key cooking ingredients, such as authentic Asian and Indian grocery items, up 128% and 185% respectively in terms of value sales.

Baking is also high on the homestay agenda with an increase in key ingredients such as sugar 64% Volume, flour, 156% volume growth. In fact, In the past four weeks Australians have stockpiled enough flour to last approximately 65 days, while bread mix has sold more than double the expected volume and has seen dollar growth of 202%.

Sources:

- 1 Source: Nielsen Digital Content Ratings, Daily Tagged, 29/03/20, vs 01/03/20, Digital (C/M), People 2+, Total Time Spent, Text, Food and Cooking sub-category.

- 2 Source: Source: Nielsen Digital Content Ratings, Daily Tagged, 27/03/20 vs 28/02/20, Digital (C/M), Persons 13-24, Total Time Spent, Text, Food and Cooking sub-category.

- 3 Source: Nielsen Digital Content Ratings, Daily Tagged 01/01/2020 – 31/03/20, Digital (C/M), Persons 2+, Total Time Spent, Text, Food and Cooking sub-category.

- 4 Source: Digital Content Ratings, Daily Tagged, 29/02/20 – 01/03/20, 28/03/20 – 29/03/20, Food and Cooking sub-category, Digital (C/M), People 2+, Total Time Spent, Text.

ABOUT NIELSEN

Nielsen Holdings plc (NYSE: NLSN) is a global measurement and data analytics company that provides the most complete and trusted view available of consumers and markets worldwide. Nielsen is divided into two business units. Nielsen Global Media, the arbiter of truth for media markets, provides media and advertising industries with unbiased and reliable metrics that create a shared understanding of the industry required for markets to function. Nielsen Global Connect provides consumer packaged goods manufacturers and retailers with accurate, actionable information and insights and a complete picture of the complex and changing marketplace that companies need to innovate and grow.

Our approach marries proprietary Nielsen data with other data sources to help clients around the world understand what’s happening now, what’s happening next, and how to best act on this knowledge.

An S&P 500 company, Nielsen has operations in over 100 countries, covering more than 90% of the world’s population. For more information, visit www.nielsen.com.

ABOUT THE INTERACTIVE ADVERTISING BUREAU

The Interactive Advertising Bureau (IAB) Limited www.iabaustralia.com.au is the peak trade association for online advertising in Australia. As one of over 43 IAB offices globally and with a rapidly growing membership, the role of the IAB is to support sustainable and diverse investment in digital advertising across all platforms in Australia.

The IAB Industry Charter, which was announced in October 2018, details the organisation’s focus on helping marketers and agencies understand how digital advertising can deliver on their business objectives. Foundation elements of the IAB Industry Charter include a renewed focus on standards that promote trust, steps to reduce friction in the ad supply chain; and ultimately improve ad experiences for consumers, advertisers and publishers.

Beyond the IAB’s continued focus on content and ad measurement, the Charter outlines four additional areas of activity: digital ad effectiveness, data and data privacy; standards and guidelines; and improving the digital value chain.

CONTACT

Nielsen