SYDNEY, March 12, 2019: The Australian online advertising market hit $8.8bn expenditure in calendar year 2018, an increase of 11.6% on 2017 according to the IAB Australia Online Advertising Expenditure Report (OAER) published today by PwC. The independent report, which has been detailing key online market trends since 2007, includes for the first time data points about the rate of programmatic buying, as well as CTV video advertising revenue data.

Download the Report and Infographic here.

The strong results for the digital advertising market in 2018 is underpinned by the continuing shift in consumer media consumption. Australians now spend nearly 100 hours a month on desktop, smartphone and tablets and nearly five million people access internet content on their TV screens daily.

For the full calendar year 2018, the General Display Advertising category experienced considerable growth, reaching $3.3bn for the year, a 15.8% increase on 2017. This places the category at 37% of total online advertising – the strongest share of the overall online ad market to date. Search and Directories hit $3.9bn for 2018, a 9.2% increase, while Classifieds increased 9.5% to reach $1.6bn spend in 2018.

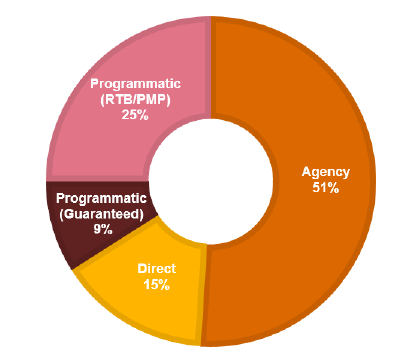

For the quarter ending 31st December 2018, the General Display Advertising category grew 5.4% to a market total of $2.3B and according to new data points captured in the OAER report for content publishers for the first time, 51% of this inventory was bought via media agencies using either an insertion order or another non-programmatic method. Of the balance, 34% of general display advertising was bought programmatically with either fixed CPM or guaranteed inventory (9%) or a variable CPM based on real time bidding via an exchange or private market place (25%), while 9% of all display advertising was bought directly.

With connected TV inventory now a significant part of the digital video market, for the first time content publishers provided data points breaking down revenue sources in this OAER report. It found that in Q4 2018, 23% of video advertising revenue for content websites was generated by connected TV inventory, while 48% of video advertising revenue for content websites was via desktop; and 29% via mobile video advertising.

Gai Le Roy, CEO of IAB Australia commented “Marketers continue to reinvest their budgets in a range of digital advertising options because they know it helps grow their businesses. 2019 will see the IAB demonstrate to marketers how they can increase the effectiveness of their spend across a wide range of digital formats and how it can work together efficiently with other media channel investments.”

Megan Brownlow, Partner at PwC said: “We are pleased to release the latest version of the Online Advertising Expenditure Report with a number of new features. The market had headline growth and is now worth $8.8B with video again the bright spot,making up 42% of the general display market and up 26.2% on 2017.”

For calendar year 2018 Mobile advertising continued to drive strong growth in both General Display and Search and Directories, reaching $4.2bn in 2018, a 34.9% increase year on year. Mobile advertising now makes up 63% of total General Display advertising.

Video advertising grew 26.2% to reach $1.4bn in 2018, demonstrating the continued positive trend for publishers as brands continue to seek premium environments in which to showcase their offerings. The Report notes that with connect TV advertising remaining a big focus, the use of technology and strength of content will be pivotal in differentiating publishers in this segment.

The new data points around buying methods and video revenue was supported by a number of contributors including Amobee (including Videology), carsales.com.au, Daily Mail Australia, Domain, Guardian News and Media Limited, Here, There & Everywhere, Mamamia, Multi Channel Network, News Corp Australia, Nine, REA Group, Seven West Media, SpotX, TEN and Verizon Media.

Listen to the IAB Podcast interview with Megan Brownlow, PwC partner and author of the Online Advertising Expenditure Report.

The full report will be available for IAB members at www.iabaustralia.com.au

/Ends

About the Interactive Advertising Bureau

The Interactive Advertising Bureau (IAB) Limited www.iabaustralia.com.au is the peak trade association for online advertising in Australia. As one of over 43 IAB offices globally and with a rapidly growing membership, the role of the IAB is to support sustainable and diverse investment in digital advertising across all platforms in Australia.

The IAB Industry Charter, which was announced in October 2018, details the organisation’s focus on helping marketers and agencies understand how digital advertising can deliver on their business objectives. Foundation elements of the IAB Industry Charter include a renewed focus on standards that promote trust, steps to reduce friction in the ad supply chain; and ultimately improve ad experiences for consumers, advertisers and publishers.

Beyond the IAB’s continued focus on content and ad measurement, the Charter outlines four additional areas of activity: digital ad effectiveness, data and data privacy; standards and guidelines; and improving the digital value chain.

For further information about IAB Australia please contact:

Gai Le Roy

CEO – IAB Australia

T: 0408 431 455

Pru Quinlan

Einsteinz Communications

T: (02) 8905 0995