Apple’s iOS 14.5 was released in late April 2021 in Australia – and since then all iPhone, iPad, and Apple TV app developers are obliged to gain consumer opted-in permissions to track their activity across other apps and websites via their device’s advertising identifier (IDFA), for targeted advertising and to measure campaign effectiveness.

We have engaged a representative group of our members on the initial impacts, some useful data points and recommendations so as to help support both marketers and app developers/publishers through the related changes.

Lloyd Lim, Director of Product Management – Mobile, PubMatic

What initial recommendations can you share based upon your experiences of the first 25 days of ATT?

Given the potential impact to publisher yield, especially for cost-per-install (CPI) campaigns, it’s important for publishers and app developers to take steps to mitigate the changes to the IDFA. So steps we suggest taking are:

1. Pass as many parameters as possible in the bid stream (such as app bundle, app store URL, etc). Extra information included in the ad request will make your inventory more desirable through non-IDFA signals.

2. Adopt Apple’s SKAdNetwork framework to support app-install campaigns. The potential absence of IDFA in the iOS environment will make it challenging for performance advertisers to track app installs. Apple is providing the SKAdNetwork framework for advertisers to measure the effectiveness of app-install campaigns without the ability to track individual users.

3. Plan to regularly update your app monetization SDKs. We expect that mobile app monetization SDKs will make a series of updates in reaction to this change. Keeping your SDKs up to date should help you get the best yield. SDKs with cloud-side demand integrations will help reduce the number of updates that need to be made on the app.

4. Explore more revenue opportunities to attract brand dollars, as opposed to focusing solely on CPI campaigns. One of the most immediate impacts of IDFA restrictions will be a declining number of iPhones that can be identified by app-attribution companies. Marketers rely on such platforms to measure the effectiveness of their CPI campaigns using a consistent methodology to deduplicate and attribute a download to the correct media partner. Since brand campaigns don’t involve a passback to the App Store, they are less complicated by the IDFA restrictions and are still measured in traditional methods like cost-per-click.

Could policies such as these result in an ever-increasing reliance on first-party data, thereby ultimately limiting advertising’s reach across the open internet and incentivising walled-garden strategies in the longer term?

We believe that publishers who own their own first party data are in a prime position to take centre stage in providing marketers with compliant options to allow them to effectively engage with audiences. We would encourage publishers who are not already doing so, to build relationships with their users that encourages them to log in (and become authenticated). But unless you have massive scale first party data is not enough. It can be difficult to model out what your users are doing, beyond your direct view and it can be difficult for advertisers to reach new audiences. Second and third-party data is extremely valuable in delivering better insights and scale.

A series of small walled gardens, without the ability to tie attribution and frequency across them is not a direction we should be going as an industry. Rather, the goal should be to work together to provide a complete solution that competes with the existing walled gardens.

The deprecation of the third-party cookie, and the advent of new alternative IDs is an opportunity for the industry to build a privacy first solution that works across all devices and channels. There will likely be a small number of widely adopted solutions – which is not a bad thing, we have all learned through experience that it’s not good to rely on one dominant solution. But these few solutions should provide a unified view across the entire ecosystem to offer advertisers a standardised, privacy-focused solution that is adopted by advertisers, publishers and the technology in between.

It’s worth remembering that if advertisers can only target within walled gardens, reach becomes severely hampered. By contrast the open internet is limitless. Advertisers need the open internet, and so do consumers.

Richard O’Sullivan, Vice President & General Manager AU/NZ, InMobi

From a consumer privacy perspective do you believe that this is the right type of product evolution for the industry?

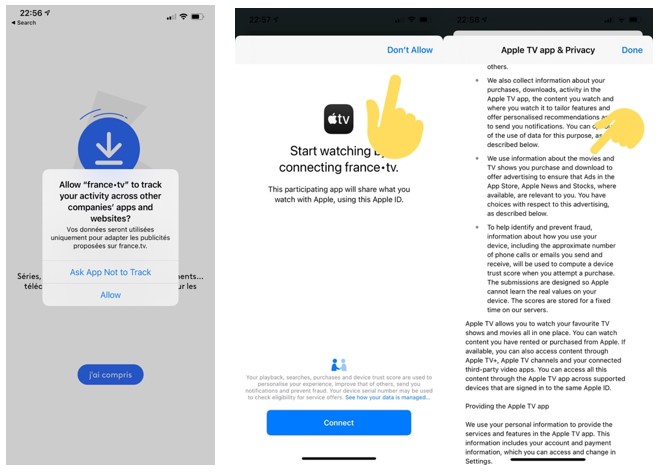

The release of Apple’s AppTrackingTransparency framework is a result of the greater push from consumers to ensure they have ultimate control over their data, and InMobi is supportive of this overall goal. Naturally, the policy does have an impact on the ecosystem, and we are working with our advertisers and app partners globally to mitigate potential fallout they may see from this move. It is also interesting to note that despite the greater focus around privacy, their own approach for owned and operated apps have taken a different stance.

image source: Nicolas Rieul (@nicolasrieul) via Twitter

However, it is important to remember that consumers while concerned about privacy also expect to have curated, personalised experiences when interacting with brands.

According to an Accenture survey on data privacy, consumers want brands to drive more personalized engagement and 73% are ready to share data if brands are transparent about data handling and the value delivered. Although there is no clear consensus as to what the solution is, stakeholders are innovating and experimenting with ways to maintain addressability whilst being compliant.

What initial impacts have you seen from these enforced changes from Apple on digital marketing over the last 25 days?

At this stage we are still assessing initial impacts, but the key has been to make sure both the buy and supply sides are in sync in adopting the required resources to successfully transition to iOS 14.5

Brand advertisers have seen a drop in spend on iOS traffic as they still adjust their strategy to effectively use LAT traffic. However performance advertisers have been remarkably aggressive in using LAT traffic and this has to do with Apple’s SKAdNetwork implementation.

Have you seen a significant reduction in reach and campaign volumes?

Not too significant as the % of iOS 14.5 request is still minimal due to the dependency on user OS upgrade. Parallelly buyers have been proactive and have started adjusting their budgets to prioritize LAT traffic (Limit Ad Tracking), PMPs and SKAN-enabled supply, where they can optimize their campaign metrics and ROI.

How have you found working with both Apple’s SKAdnetwork API and Private Click Measurement features?

Apple’s SKAdNetwork – like any new tech – had some teething issues as DSPs, SSPs and publishers faced issues in making sure signals are being sent and received properly throughout the supply chain. Advertisers are still coming to terms with limitations like privacy threshold which limit the attribution data DSPs can see if they don’t cross an impression threshold (not known publicly) for a particular campaign ID.

We are still evaluating Private Click Measurement and how to make that successful for our advertisers, so don’t have a point of view yet.

What initial recommendations can you share based upon your experiences of the first 25 days of ATT?

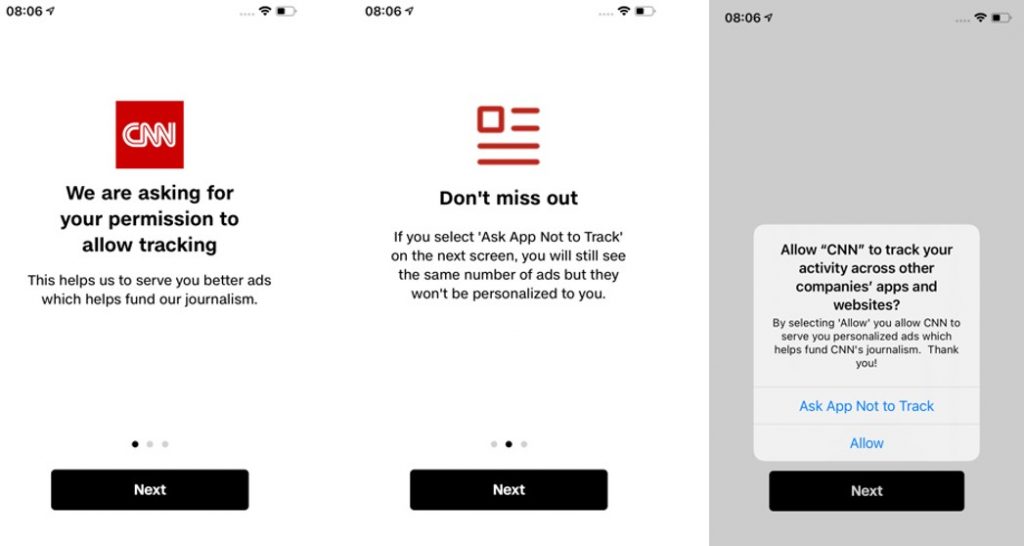

Soft native prompts are a must for Publishers/ Developers to try to explain the value of opting-in and get users in the best mindset to give consent to use their data. A great example is one we’ve seen from CNN (Screen 1+2 are pre-prompts):

Additionally:

• Publishers/ Developers should Adopt SKAN/ ATT to ensure attribution and keep capturing budget from performance DSPs specifically.

• Leverage InMobi’s UnifID solution to seamlessly integrate multiple Universal ID partners and maximize your audience addressability.

Manuela Cadd, Country Manager AU/NZ, Verve Group

What initial recommendations can you share based upon your experiences of the first 25 days of ATT?

The announcement of the ATT rollout has been stirring up the industry for almost a year now. During that time, we have put in a lot of effort into educating and guiding publishers and advertisers alike to ease them into this “new normal”. But since the ATT finally dropped, we have started receiving more detailed and specific requests from publishers who are now running into limitations on several fronts. App developers are increasingly encountering edge cases that are often not clearly covered in the ATT and SKAdNetwork specifications. Therefore, we see the need for comprehensive documentation and developer support from Apple’s side, while the industry works on standards and best practices to tend to all publishers’ needs. Apple has already followed up with a first SKAN patch, as well as more detailed guidelines for publishers and app developers on how to articulate the value of opting-in to ad tracking for users.

On our own exchange, we are currently seeing a gradual pick-up of iOS 14.5 adoption among our publishers. iOS 14.5 currently makes up for less than 20% of our global iOS traffic. We expect this share to grow as publishers learn from each other on the best practices of ATT implementation and as more devices move to the updated version. If you are a publisher or app developer who is just getting started or on the edge, we would recommend you go over our checklists and tips to safeguard your ad revenues.

If you are an advertiser interested in maintaining granular addressability on iOS without compromising on user privacy or scale, read up on alternative targeting options such as anonymized on-device audiences, which are built from non-persistent signals with the help of machine learning algorithms.

Could policies such as these result in an ever-increasing reliance on first-party data, thereby ultimately limiting advertising’s reach across the open internet and incentivising walled-garden strategies in the longer term?

Following data protection regulations in Europe (GDPR) and the US (CCPA), Apple is now bringing data protection to the forefront of mobile marketing again. Under the pretext of data privacy, Apple is building its own ad tech, limiting ad tracking on iOS devices and keeping valuable first-party data from the App Store to themselves.

This practice has not only kindled debates and legal actions with other global players, but also seems to encourage larger publishers to mimic Apple’s tactics by building content fortresses and developing their own ad stack.

However, the process of building up such an ecosystem takes time and requires dedicated focus and a strategy to establish an in-house ad stack platform. Since scale and scope matter, the options to create walled gardens on first-party data are only actionable for bigger publishers with a vast portfolio or those with resources for vertical expansion into ad tech. On the other hand, smaller publishers will not be able to keep up with their larger competitors while still holding power over small decentralized sets of valuable first-party data. To make the best use of it and drive their ad revenue, these publishers will need to rely on intermediaries to consolidate their first-party data and make it available to buyers at a meaningful scale.

One option to profit from first-party data access as a publisher is the collaboration with companies that offer targeting based on first-party data hosted in data clean rooms.

As a second option, publishers can add support for alternative personal identifiers such as The Trade Desk’s Unified ID 2.0. However, to be able to target based on these IDs, implicit user consent is needed. Lastly, publishers have the option to both safeguard user privacy without the need to collect opt-ins or pass first-party data to advertisers for targeting purposes by generating audience segments directly on a user’s device. Today, such anonymized targeting solutions are offered by Google (Federated Learning of Cohorts) and Verve Group. These on-device audiences are built on contextual, device, and app signals that generate addressable cohorts without mapping them to a specific user.

Dan Richardson, Head of Data – AU/NZ, Verizon Media

Could policies such as these result in an ever-increasing reliance on first-party data, thereby ultimately limiting advertising’s reach across the open internet and incentivising walled-garden strategies in the longer term?

Yes, which is why the 53% of companies* who aren’t yet using first party data for their media and advertising should be worried.

If they haven’t already done so, brands and publishers need to prepare a watertight first party data strategy, quickly.

Thankfully, there’s already a number of solutions available such as our Next-Gen Audiences. By using machine learning and algorithms on a seed set of known consumer activity, advertisers can safely reach modelled audiences. The end product is validated for accuracy against the seed audience and through an objective third party such as Nielsen or Comscore.

Solutions like Next-Gen Audiences are the privacy conscious evolution of Contextual Targeting and Lookalikes. They allow for reach into the unknown web, which is basically publisher environments where a logged in user is unavailable.

There are a range of options using first party data directly, or as the seed for learning more about your audience. Brands should lean in and test what is on offer, versus restricting themselves to inventory and audiences available in the walled gardens.

*State of Data Report conducted by IAB and Ipsos, March 2021

What initial recommendations can you share based upon your experiences of the first 25 days of ATT?

With iOS14.5 opt-in rates already sitting at 15% globally* it’s been a massive wake up call for the ad industry.

Our recommendation is to look at alternative solutions, like our Next Gen Audiences, to test and work with in an identity challenged ecosystem. By doing this, you’re setting yourself up for success. It’s great to get in early and develop best practices and experience in managing campaigns this way.

In addition, publishers and app owners should take advantage of the pre-prompt option to clearly explain your value exchange and reason you’d like the ATT turned on. This is again, a great way to start the dialogue with consumers to get the opt-in process to a point where you have first party, consented users who will help power your future advertising success (and app monetisation).

*Source: Flurry Analytics, Data through 16/5/2021, n=5.3M daily mobile active app users using iOS versions with ATT framework (iOS14 and above)