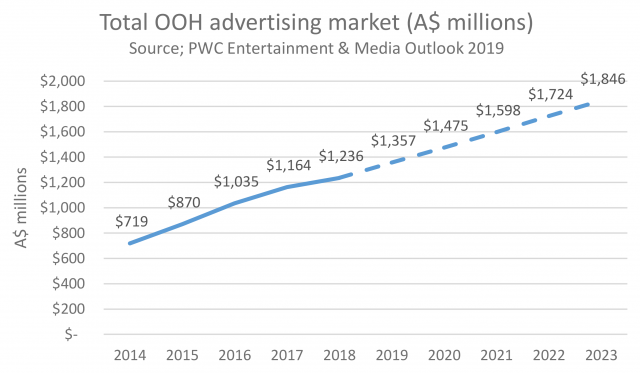

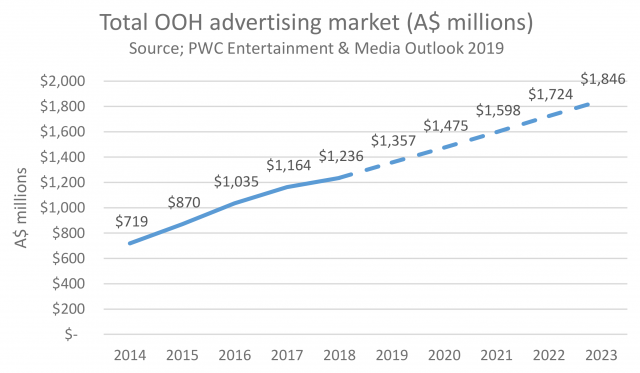

Advertising investment in out-of-home advertising has experienced strong growth over the last 5 years driven by media buyers embracing the advancements from digitisation. Digital formats now represent over half of all out-of-home ad spend in Australia.

There are further opportunities in digital out-of-home (DOOH) advertising that have potential to drive growth into the future. The PwC Entertainment and Media Outlook predicts the total out-of-home advertising market in Australia to grow at CAGR of 8% from 2019 to 2023.

The PwC Entertainment and Media Outlook cites two things underpinning this predicted growth:

“1. Available inventory will continue to increase due to digital functionality allowing for rotating advertising messages which will accommodate for more advertisements on a single physical asset at any one time

2. Emerging functionality such as dynamic creative messages and audience targeting improvements will entice new advertisers and increase investments, as well as retain existing advertisers”

IAB and PwC UK have partnered on a new study, with the support of Broadsign, to understand the state of audience data and programmatic trading in the DOOH industry across five markets: Australia, Canada, the Netherlands, the UK, and the U.S.

PwC interviewed senior industry executives across media companies, ad tech companies, and agencies. All expressed their enthusiasm about the potential of programmatic digital- out-of-home (pDOOH) campaigns to drive innovation and growth by delivering real value for advertisers.

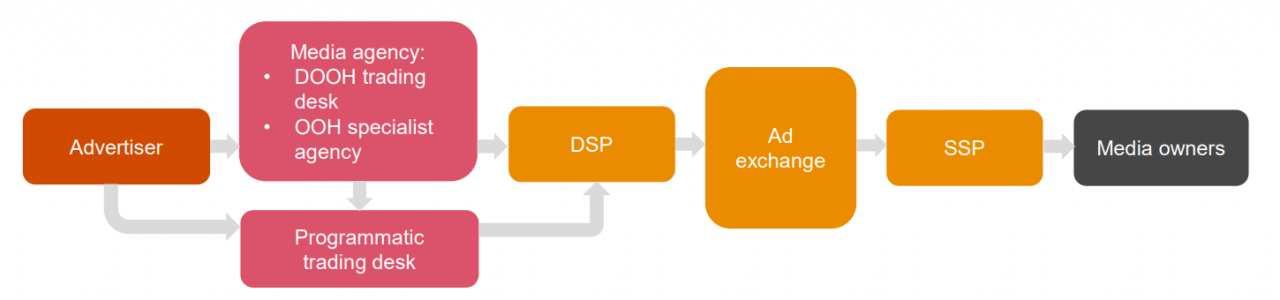

Programmatic advertising is defined as the use of automation in the buying, selling, or fulfilment of digital display advertising. pDOOH enables digital media buyers to set what audience they want to reach, the environments in which their ads should play, and other conditions that matter to a campaign, such as time of day, weather conditions, etc. When the circumstances are right, the transaction automatically takes place and the ad displays on screen.

A simplified illustration of the programmatic supply chain:

Source: Growing Programmatic Digital Out-of Home: Opportunities and Challenges Report by PWC and IAB

Qualitative findings from the IAB and PWC study in the Australian market have identified Programmatic DOOH (pDOOH) is in its infant phase. Only a small number of buyers are on a limited test and trial basis with limited inventory available in the open marketplace.Most buyers and ad tech platforms see 2019 as a year of test and trial while the industry comes to grips with programmatic DOOH and the market settling down post consolidation.

DOOH media owners in Australia are primarily focussed on exploring programmatic from a data-driven planning/buying, media sales and workflow automation perspective and real-time bidding via open auction exchange is not currently the focus.

Overall the study also identified 3 key themes as opportunities in the growth of pDOOH that can be applied to the Australian market:

More market education –

Education of clients, agency planners, and buyers (both in programmatic trading teams and traditional OOH buyers) was identified as being key to accelerating the growth of pDOOH. Understanding the benefits of DOOH, the ways in which programmatic trading can bring value to clients, and how you can trade DOOH programmatically, were identified as the areas of focus for education.

Need for quality and transparency in audience data –

The buy-side is generally looking for location data and screen specifications from media owners, which they can then overlay with their own first-or third-party data. Location based targeting is prevalent and respondents highlighted some trusted sources of audience data in the Australian market (including telco operators and established loyalty card operators).

Data privacy regulations and their evolution and implementation is a key factor of concern on the buy-side, including quality and collection methods of data. Understanding the accuracy and methodology of the underlying data is key for media buyers. For pDOOH buying to increase, a standardised methodology for data definition and collection needs to be implemented and adopted by all players in the market. Initiatives developed by IAB Tech Lab for digital media, such OpenRTB, VAST, Data Label, and Open Measurement specifications, could play a role in providing the industry with data standardisation and transparency.

Improvements in audience and advertising effectiveness measurement –

The study reiterated that the current industry-led audience measurement needs to evolve with the increased utilisation of digital formats. Audience measurement data, MOVE produced by Outdoor Media Association (OMA), was developed for static panels and currently does not accurately measure digital panels. This limitation has been recognised by the OMA. In 2018, the MOVE board committed to rejuvenate MOVE to more accurately measure audiences for digital out of home signs. In June 2019 MOVE announced it was undertaking a neuroscience study to assess audience engagement with digital and traditional OOH formats, environment and travel modes as part of this plan to provide a new metric to measure digital out-of-home (DOOH) advertising.

The report also acknowledges that a gap exists with attribution modelling for the OOH industry. In defining multi-touch attribution models, the contribution of DOOH is still being determined. Mobile device IDs and transaction data have been highlighted as key for attribution models in pDOOH and key to advanced attribution capabilities. Tracking mobile device IDs exposed to a DOOH ad to client data collected through loyalty card or transaction data collected from retailers and credit card companies (as allowed by laws and regulations) is seen as way of closing the attribution loop within the industry if the campaign objective is to increase sales. If a consumer’s path to purchase can be mapped from mobile location data to transactional data at a point of sale, the attribution loop could be closed. As the industry moves to adopt a more data-driven planning/buying approach, there is optimism that a robust solution will be eventually identified and developed.In the meantime, media owners are carrying out their own 3rd party industry research to continue to prove the effectiveness of the DOOH industry and the effectiveness of their network.

As the digital out-of-home industry expands the IAB sees a role to play in all 3 areas of opportunity to help drive confidence for media buyers in increasing DOOH advertising expenditure.The IAB DOOH Taskforce has published a glossary as a first step in standardising a common language for the DOOH industry to help aid understanding. As automated and programmatic buying increases there is a need for digital specialists to get up to speed on OOH terminology and the OOH specialists to understand digital terms. The IAB Australia Digital Out-of-Home Glossary of Terms is available to download from the IAB website.

Over the coming months an IAB Australia DOOH working group will roll out further education pieces on DOOH processes and audience data initiatives.

Download the full report ‘Growing Programmatic Digital Out-of Home: Opportunities and Challenges Report by PWC and IAB’for US and Canada from the IAB US website.