How can the Australian Market ensure Healthy Future Growth?

There has been a fair amount of recent discussion and coverage in relation to ad fraud for CTV inventory in overseas and local trade press of late. IAB Australia wanted to outline the state of the Australian market generally and for broadcaster CTV inventory specifically and provide guidance on how media buyers can take an active role in ensuring that what they intend to buy is what they get.

CTV – the success story of 2021?

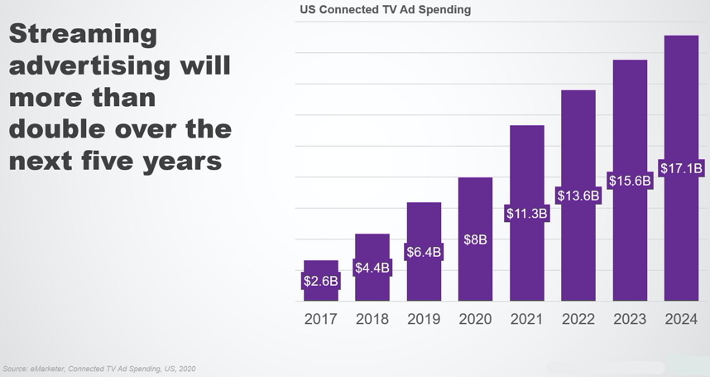

Advertising spends through Connected Televisions (CTV) has been a success story in 2021 in Australia. The consumption of high quality long form digital video displayed on a TV screen is outpacing the rest of the ad supported media market, this in turn is driving a significant increase in investment from advertisers.

In the IAB Australia’s most recent expenditure report video advertising as a category, continues to outperform the overall general display market – with a 15% growth in FY20 versus FY19 and increasing its share of the general display market to 53%. As a critical element of this growth – publisher’s video expenditure share attributed to connected TV has increased from 23% to 41% over the last 15 months.

Product Definition

In terms of a simple definition – a Connected Television is a television set connected to the internet through the built-in capabilities of a smart TV, or else through a streaming device or gaming console – which also enables the viewing of video content to be streamed on the larger screen.

General recommendations re how to ensure buying quality inventory

Due to the unique market make-up in Australia of a number of large premium broadcasters there is a healthy supply of quality BVOD content and Australians in 2021 have been flocking to consume this content on Connected Television. This has enabled these suppliers to package products and audiences into buyers through direct deals ensuring that marketers can meet their requirements without exposing themselves to the risks of open-market bidding environments.

Jordan King, Director of Audience and Automation at Nine said: “The topic of Ad fraud on CTV is a murky space as there is limited visibility into the tracking and reporting of the alleged fraud. Our advice to marketers is to only include supply from premium Australian broadcasters they have established relationships with when accessing CTV inventory.”

Proof points as to how the Australian marketplace enables buyers to access high quality fraud free inventory

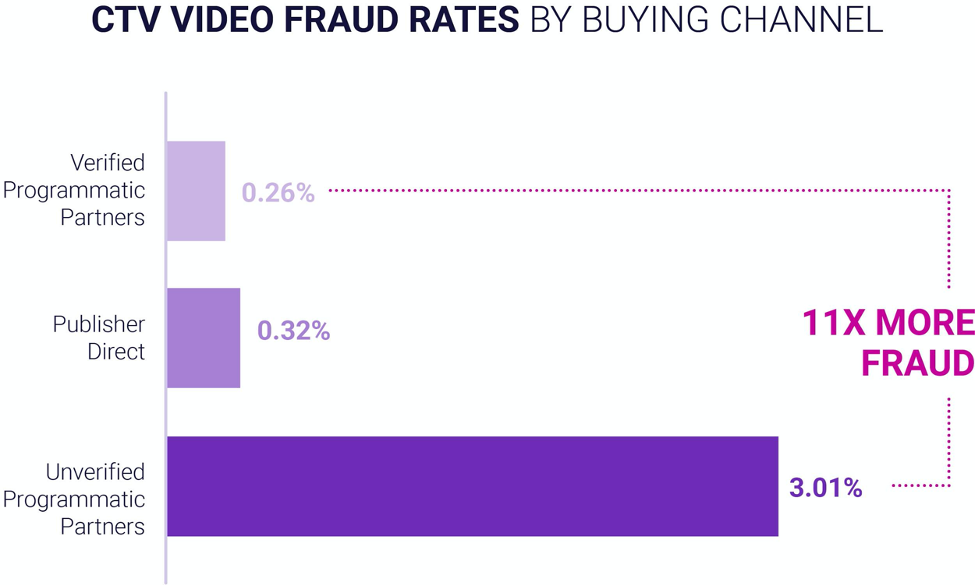

Based upon the recent ‘2020 Global Insights Report’ from Double Verify, buyers working with programmatic platforms without any verification are x10 likely to be exposed to fraudulent inventory on CTV when compared to dealing with publishers directly.

Source: DoubleVerify

Nicole Bence, Network Digital Sales Director at Seven Network said “ Considering the growth, It’s not surprising to see questions about ad fraud on CTV, although the local data is quite different to some other market. Consumption of premium, professionally produced video content on CTV provides a brand safe and impactful opportunity and we have never seen fraud levels higher than 0.1%. No one needs reminding how valuable the largest screen in the house that captures the most attention is, coupled with the smarts and targeting capabilities of digital. Seven is actively working with the IAB through its Tech and Video Councils to continue to deliver innovative solutions to the Australian market.”

According to the ‘2020 Global Insights Report’ from Double Verify, fraud follows ad spend, especially within emerging channels like CTV, where measurement technologies are not widely adopted and demand outstrips supply. Fraud is far less likely to occur directly in a premium publisher’s own closed-app ecosystem, but even in these types of environments vendors will generally detect some forms of harmless, but still invalid, traffic. Invalid traffic isn’t exclusive to bad actors or fraudsters, but rather it also includes bot/data centre traffic used for legitimate purposes. For example, there may be test bots created that regularly perform automated validations against an app to ensure it’s running properly. These bots are likely to generate impressions as they verify the app for legitimate reasons and need to be filtered out.

James Young, Managing Director, Australia at Magnite said “Australian audiences have been quick to adopt streaming services in Australia and the broadcasters have been quick to respond to this change in consumer behaviour, developing their services quickly to meet market demand. This has led them to take a commanding position when considering all AVOD options in the market. When considering this in regards to fraudulent activity, we can look to the nature of how advertisers and publishers communicate with each other. For the vast majority of deals, there is a one to one discussion between the advertiser and publisher resulting in a deal ID being generated which minimises any opportunity for fraudulent behaviour. As the ecosystem expands and more AVOD players enter, it is important for buyers to maintain strong connections with these content providers so that they ensure that they are getting what they pay for. Programmatic trading is an amazing efficiency gain, but the human element to negotiation and trading hasn’t disappeared.”

Additionally, with server-side ad insertion (SSAI) being standard in CTV environments, bots are able to mirror SSAI traffic to commit fraud at scale. Hence the recommendation to work directly with publishers and/or with programmatic partners that can certify their CTV supply through MRC accredited verification partners.

Peter Barry, Regional Director, ANZ & Head of Audience, APAC at PubMatic said “With the Australian CTV market being dominated by premium broadcasters, we see extremely low rates of CTV fraud here. That said, it is important for buyers to know exactly who they are working with when it comes to CTV. The three major CTV fraud schemes uncovered this year – DiCaprio, Icebucket and Monarch – all relied on spoofing. They all could have been avoided by buyers working with trusted SSP partners with strict vetting processes like PubMatic. PubMatic’s inventory quality team carries out thorough evaluation before onboarding new publisher partners so that we can offer buyers peace of mind with a fraud-free guarantee. In ANZ, we have seen no clawback for CTV. When buying direct, advertisers should also ensure they are really buying what they think they’re buying. The Monarch scam saw buyers caught out buying direct from low quality Roku apps like Ninja Roku rather than direct from Roku itself. As with most things, in CTV if it sounds too good to be true, it probably is.”

As the market grows how the industry must continue to protect buyers

Moving forwards the predictions both globally and locally are of continued growth, and as a result we’re likely to see more supply and an increase in open-market buying for CTV audiences and products.

IAB Australia and IAB Tech Lab will be working on ensuring that there is enough education, best practices, recommendations and standards in the Australian market to ensure that this growth can be protected from marketers taking any unnecessary risks in terms of how they access and validate any future supply.

Shailley Singh, VP Product, IAB Tech Lab said “IAB Tech Lab has a comprehensive portfolio of products that support CTV advertising for band safety, ad fraud risks, ad delivery, identity & privacy and measurement. We are ramping up on improving these capabilities with enhancements to fully meet the needs of this fast growing segment. Some upcoming releases that will help mitigate CTV fraud risks are app-ads.txt for CTV , SSAI macros for VAST 4 and SSAI guidance and Open Measurement SDK for tvOS, Android based devices and more CTV platforms.”

For further details on how to fully support your CTV initiatives please read the CTV Advertising Standards: IAB Tech Lab Standards & Guidance