Nielsen has released results from The Nielsen Global Survey on New Product Purchase Sentiment. With millions of dollars spent on new product development every year, these latest Nielsen insights reveals critical clues into new product purchase intentions around the world, including consumer sentiment about purchasing new products, product categories which enjoy the most interactions, and the information sources influencing consumers’ new product purchasing activities.

Key themes and insights include:

- More than half of online Asia Pacific consumers (55%) prefer to purchase new products from a familiar brand rather than switching to a new brand

- Around three in five consumers in Asia Pacific wait for new products to be proven before purchasing

- Consumers in Asia Pacific are less likely than in any other region globally to consider local brands versus larger global brands when considering new product purchases – just two in five (38%) prefer to purchase local brands over global brands

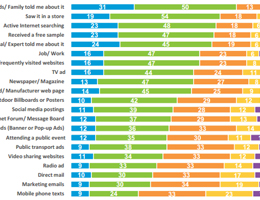

- Word-of-mouth is the most persuasive form of new product information for consumers in Asia Pacific, while active internet searching, online advertising and traditional television advertising are also major influencers.