Different IAB chapters around the globe provide the market with industry data on digital ad investment in their region. Here we provide a top level comparison of data from Australia, the US and the UK for 2020 calendar year. We are also currently collating a broader review of a range of markets that will be published in May.

Sources: IAB Australia Online Advertising Expenditure Report CY20, IAB Internet Advertising Report Full Year 2020, IAB UK Digital Adspend Study 2020

Market Growth

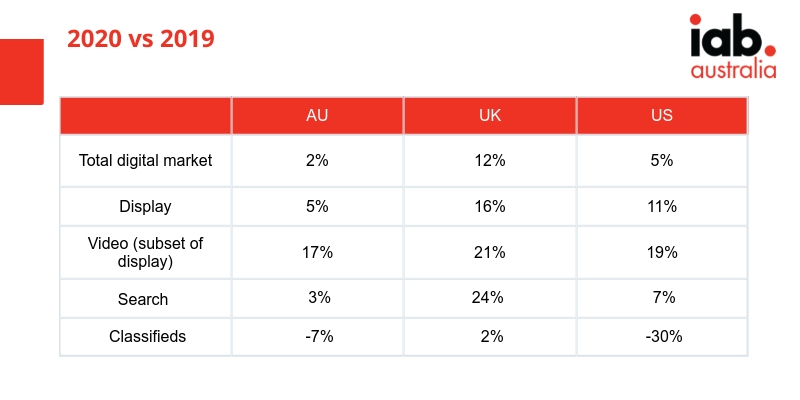

Globally digital advertising investment outperformed other media channels and saw year on year growth in an economically challenged and unstable environment. The US market had solid growth across many advertiser categories but was assisted by a very healthy ad spend for the election. Video remains the strongest format for growth across all markets and the classified (listings) revenue was the most challenged as the auto and employment sectors struggled for much of the year.

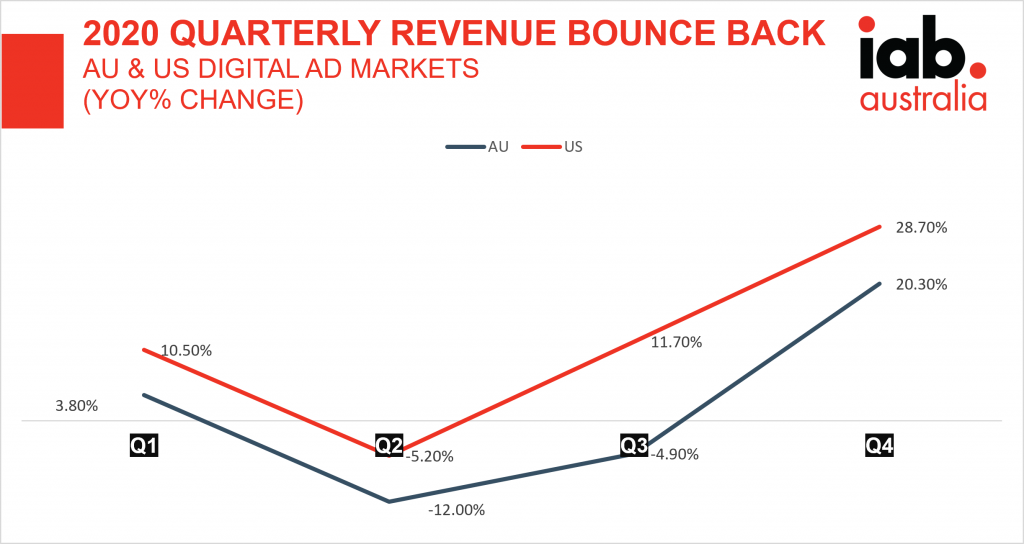

Strong Bounce Back at the End of the Year

The combination of the return of confidence in the economy with the announcement of successful COVID 19 vaccines, successful virus control locally in Australia, the return of delayed marketing investment and the traditional strong seasonal lift all contributed to a incredibly strong bounce back in the US and Australia in the last quarter of the year.

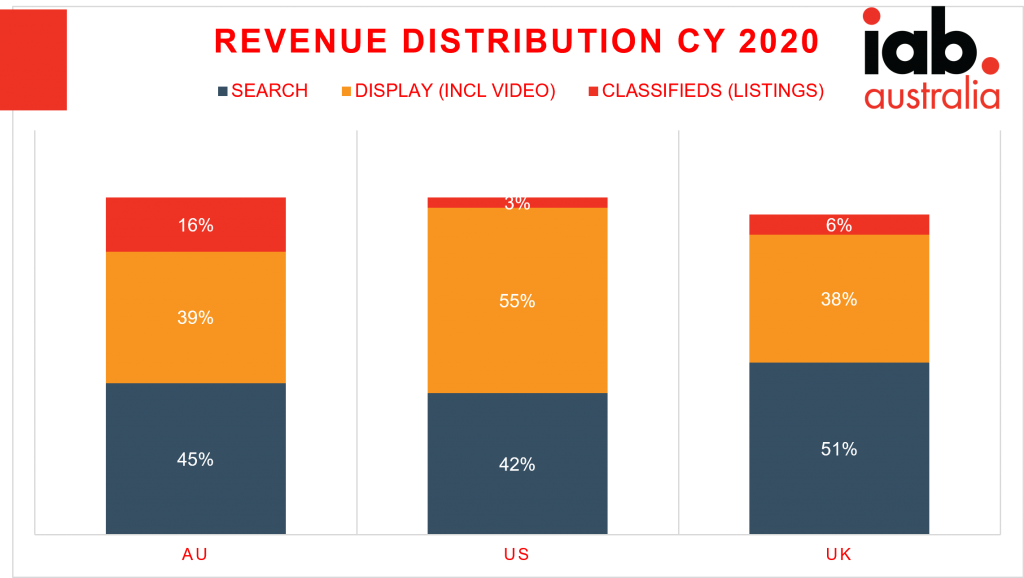

Distribution of Investment

Although the classifieds market was down in Australia in 2020, the share of the digital ad market that this revenue stream represents in Australia is much higher than other markets with strong local pure play offerings in this sector. Strong growth in video and social investment has seen the overall display share of market lift in the US market.