Since April this year, we’ve seen the repercussions of Apple’s App Tracking Transparency feature (ATT) continue to limit measurement effectiveness within the iOS mobile advertising ecosystem as users opt-out of being tracked across apps and websites for advertising purposes. We recently provided a couple of updates on tools released by Apple and Meta that we felt that marketers should be aware of when looking to roll up their sleeves and try to measure more meaningfully within iOS.

As an update (and in the week that iOS 15.2 became available in Australia) we also wanted to close out the year with some local insights and recommendations from some of our members on what they’ve seen in 2021 and what to look out for in 2022.

Insights

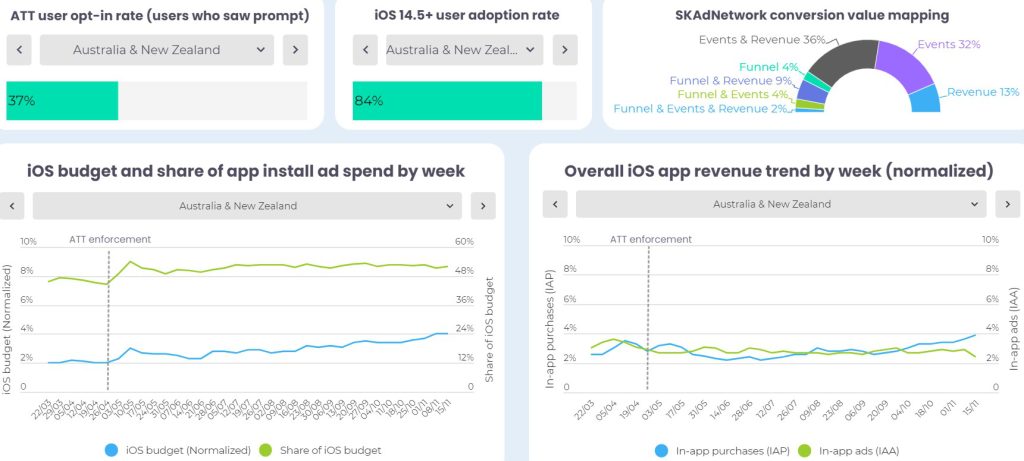

In terms of local insights, we start with a summary from the excellent AppsFlyer ATT Dashboard below:

AppsFlyer’s most recent data shows 37% in AU&NZ and they also predict that opt-in rates will gradually improve through 2022, as users come to grips with the poor user experience of untargeted ads and brands get better at optimising their prompts and providing a clearer value exchange.

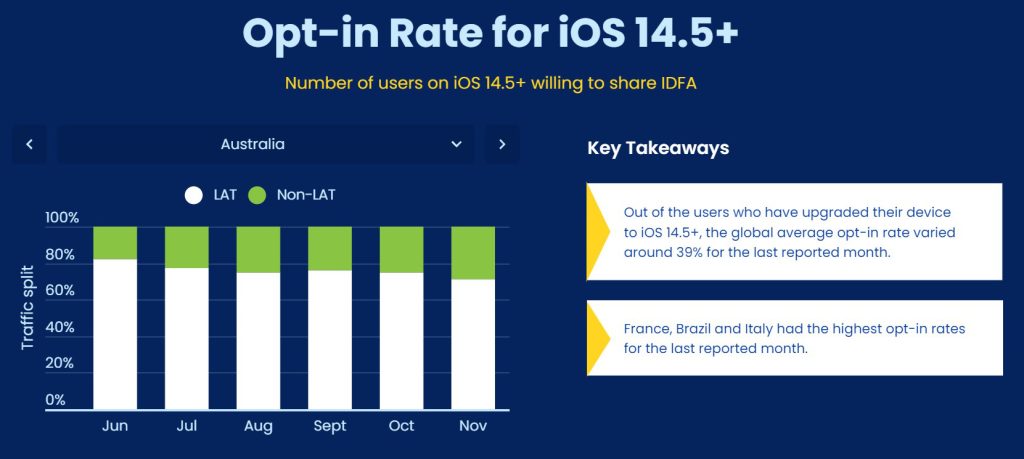

InMobi concur on this general figure, sharing that they are seeing opt-ins globally settling at around 39% in recent months which is much more encouraging than the original industry estimates of around 25% or lower. The latest Australian data from InMobi is visualised below:

InMobi also noted that all users on apps were initially classified as LAT (limit ad tracking) users until publishers had engaged with them to respond to ATT prompts. Publishers have since been testing different variations of ATT prompts by tweaking the messaging and prompt timings – before scaling this out entirely. This testing has allowed publishers to increase their opt-ins over the last 6 months or so.

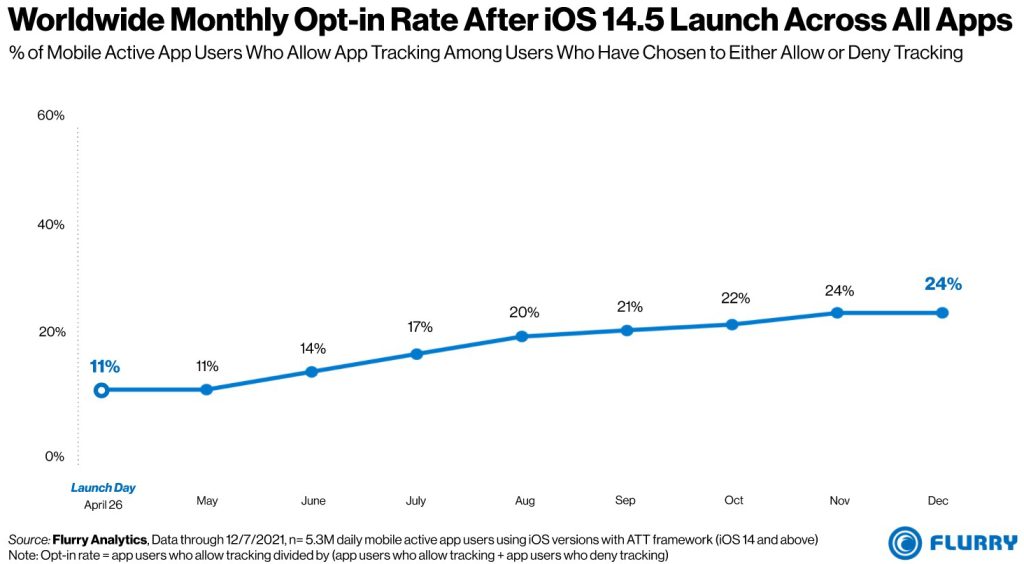

In terms of global opt-in rates, Yahoo’s Flurry Analytics this week released their latest update which includes December 2021 data – and this comes in at a lower rate of 24%. For their methodologies please see the relevant link towards the bottom of this article.

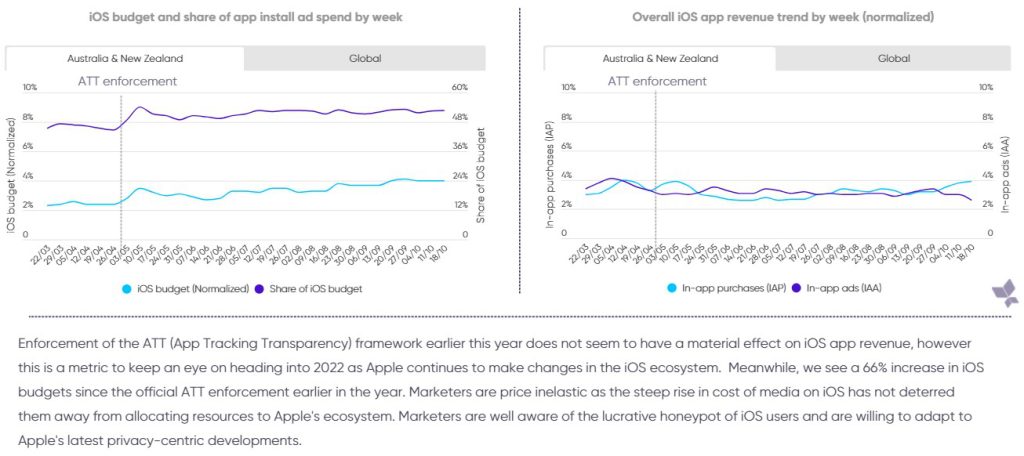

With regards to marketing impacts – App Annie’s ‘The state of app marketing in Australia & New Zealand 2021 edition‘ report (released this week) provides some interesting observations, per the below:

Whilst locally App Annie is still seeing solid numbers, from a global perspective over the past 6 months we have seen negative impacts in terms of revenues reported by some of the larger platforms.

Locally advertisers remain confident of the value of iOS audiences (even with less attribution data) and are treating ATT as no more than a technical change in the short term. Many have planned ahead by building out significant audience proxies to give them at least addressability to any desired audiences, albeit without IDFAs.

We will review what has happened through Q4 early next year and in particular any impacts on the traditionally very busy pre-Xmas season – and will be keeping an eye on any meaningful early insights from 2022 that we can share, including some direct feedback from our local marketer and media agency members.

Recommendations

We have a mix of recommendations from some of our members below, along with some links to further reading. The overall recommendation is to keep testing, observing and optimising, as this is uncharted territory for the iOS app market and that there will be no single form of implementation that works across the entire ecosystem.

AppsFlyer on owned media and re-engagement:

With the challenges of remarketing in iOS, it is no surprise that the use of owned media to re-engage existing users through push notifications, email, and in-app messages has jumped almost 45% since April. Owned media gives apps full data granularity within a 1st party data environment (privacy measures seek to prevent the passage of data to 3rd parties, not within a company’s owned properties).

More and more apps are using integrated audience segmentation and marketing automation tools to help app marketers efficiently re-engage users. This allows marketers to create tailored messaging, and even exclude users who have already responded to a campaign from seeing similar ads across other owned channels.

AppsFlyer on testing and optimising the user prompts:

There are compelling reasons to show the prompt to improve optimization. However, some apps may choose not to show the prompt so as not to disrupt the UX and risk drop-off, while settling for limited aggregated attribution with SKAdNetwork.

The earlier the prompt is shown, the greater an app’s optimization capabilities. Conversely, the later consent is given, the more limited your campaign optimization and the lower your reach due to industry-wide low retention rates.

The later the prompt is shown, the higher the opt-in rate is likely to be (within several days of install). Once a user has an understanding of the value of the app to them, they are far more likely to be comfortable with opting in.

Known brands have an advantage when it comes to gaining opt-in: trust. The same applies to active users of an existing app who are already invested in the app by the time they update to iOS 14.5 and see the prompt.

InMobi on alternative targeting options:

For the buy side, we eased the operational effort for media buyers through PMP targeting options that helped them find relevant users and inventory more efficiently. We made it simpler to target or exclude LAT traffic, easier to target contextually-relevant apps using standard IAB categories, and set up KPI-based PMPs for buyers optimizing towards upper-funnel media KPIs like viewability, video completion rates (VCR) and click-through rates (CTR).

InMobi continue to support increased SKAN adoption:

We were one of the first SSPs to roll out our SKAN-ready SDK and worked with our publishers to upgrade them to be SKAN-compliant. By June, 80% of InMobi supply was already compliant with SKAN v1.1. And we are following the same playbook for SKAN v2.2, Apple’s latest SKAN release, which introduced support for view-through attribution.

Updates from Meta:

We recognize that over the past several months, your Facebook campaigns may have experienced reporting and measurement gaps due to recent shifts in the digital ads ecosystem. To address these gaps and continue to help you drive efficient results on our platform, we accelerated our efforts to make product improvements. As of today, we’ve made the following updates around reporting and modeling:

- More attribution reporting through Aggregated Event Measurement (AEM), SKAdNetwork (SKAN), and through modeling.

- Expanded AEM and SKAN conversion reporting capabilities.

- Improved how our systems work with SKAdNetwork.

- Testing App AEM with advertisers who run Catalog Sales with plans to expand availability in the new year.

As a result, you may see improved conversion reporting especially if you’re leveraging our conversion campaign best practices.

On December 13, 2021, we will begin the rollout of modeled reporting for null conversions in SKAdNetwork (SKAN) campaigns. As a result of this update, some Advertisers that use SKAdNetwork for their App campaigns may see improvements to cost per action (CPA) and an increase in reported post-install events.

Update from Yahoo:

Yahoo DSP and Yahoo Preferred Network ( prev called Gemini) supports SKADNetwork 2.2 and 3.0 versions for both post-click and post view tracking. However, we find that SKAD provides very limited aggregate information about app installs. The post-install events are even harder to get as the user action must be completed within Apple’s timer limit. Publisher or source information is available only when Apple’s internally defined threshold is met. Overall, advertisers have just started testing iOS inventory with SKAD data and are reluctant to put a bigger budget towards it. We’re supporting the framework but It will take some time for the industry to gain confidence in this.

Some links for further reading:

IAB Tech Lab SKAdNetwork ID list tool – IAB Tech Lab has a tool for managing and maintaining your SKAdNetwork ID list. Advertisers, DSPs, and networks can register their SKAdNetwork IDs and the tool will publish a list of all registered IDs that can be downloaded by app developers and publishers.

AppsFlyer’s top 5 data trends that shaped mobile app marketing in 2021, and what they mean for 2022

Tips to optimise your iOS 14+ campaign setup in Facebook Ads Manager

Tips to improve your SKAdNetwork configuration in Facebook Events Manager

Best practices for iOS App campaigns (Google)

IAB Australia One Stop Shop on Apple’s iOS Privacy Changes

App Tracking Transparency Opt-In Rate – Monthly Updates (Flurry)

InMobi – Understanding The Role Of Campaign IDs In A Post-ATT World